UK Group Life Insurance & Group Business Protection

BROKERS, INTERMEDIARIES & EMPLOYERS: REQUEST A QUOTE HERE

Group Benefit Solutions can go a long way towards protecting your clients’ businesses, boosting

their company’s talent attraction and retention rates, bolstering company culture, and supporting

employees’ financial wellbeing by offering their dependants a financial safety net for the future.

UK Group Life Insurance

UK Group Business Protection

Employee benefits like Group Life insurance are essential

to a comprehensive compensation package and help

employers retain their best and brightest staff.

They not only positively impact employee wellbeing,

but benefits can have a direct impact on your client’s

employee engagement and productivity levels.

Our top Group Life policy features include:

- Minimum Free Cover Limit of £500,000

- Minimum 3 lives (no maximum)

Registered and Excepted Master Trusts - Prompt payment for valid claims

- Non-indemnity commission is payable (up to 40% of

the premium)

3 reasons to take out a UK Group Life policy:

- Premiums qualify as an allowable business expense.

- Alleviating employee stress can save employers up to

3 weeks’ worth of lost productivity per employee per year. - Offering world-class benefits helps to establish a

company as an employer of note.

What would happen to your client’s business if

a key member of staff died?

Could they easily fund recruitment costs, repay a

director’s loan or buy back shares?

If not, then Group Business Protection offers a cost-effective

insurance vehicle for financial peace of mind.

- Key Person Insurance:

This will be paid out on the death of a key person

within the business to help cover costs for recruitment,

loss of revenue or training for the role.

x - Shareholder Protection Insurance:

This will be paid out on the death of a working

shareholder of the business to help the remaining

shareholders retain control of their former partner’s

shares.

3 reasons to take out a Group Business Protection policy:

- Group Schemes are more flexible.

- They’re easy to administer.

- They can adapt to suit changing business needs,

which is particularly useful for partnerships and startups.

UK Group Benefit Solutions to protect your

business, your employees, and their families.

UK Group Life Insurance

UK Group Business Protection

Document and Form Library

Policy Terms and Conditions

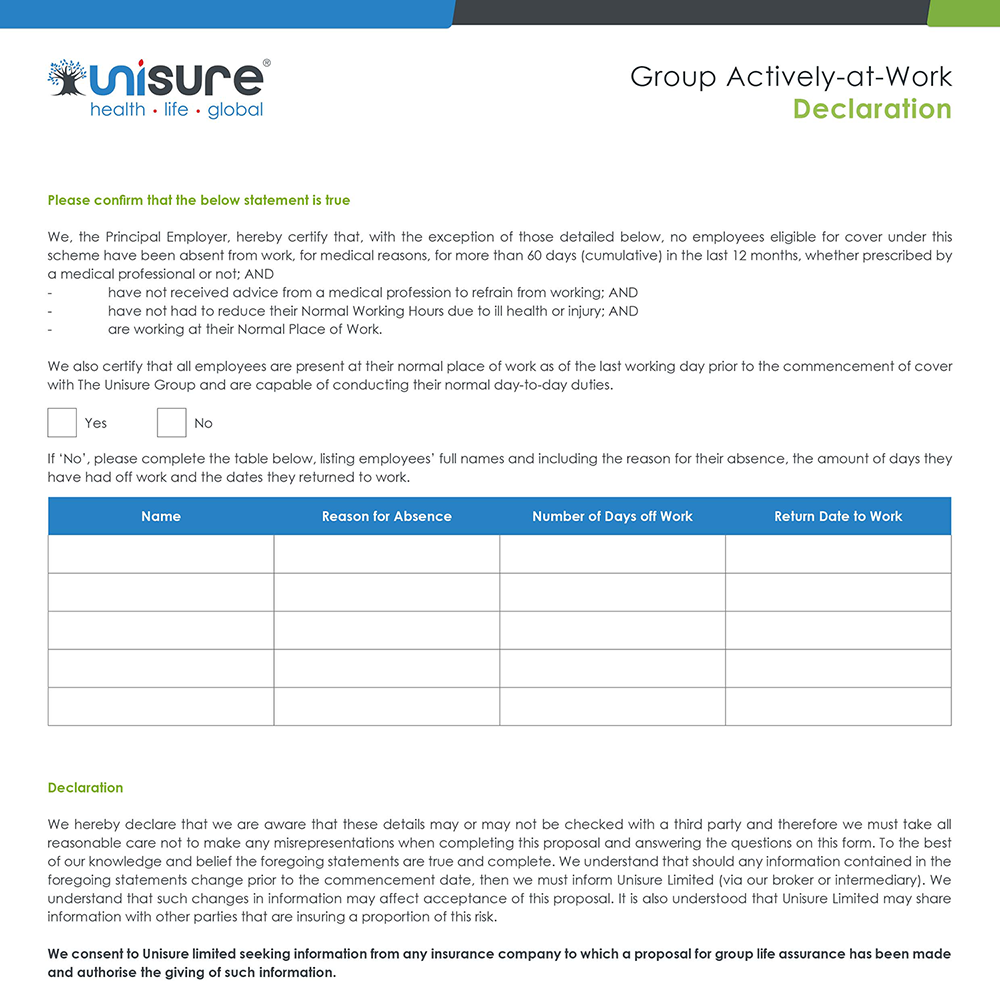

AAW Declaration

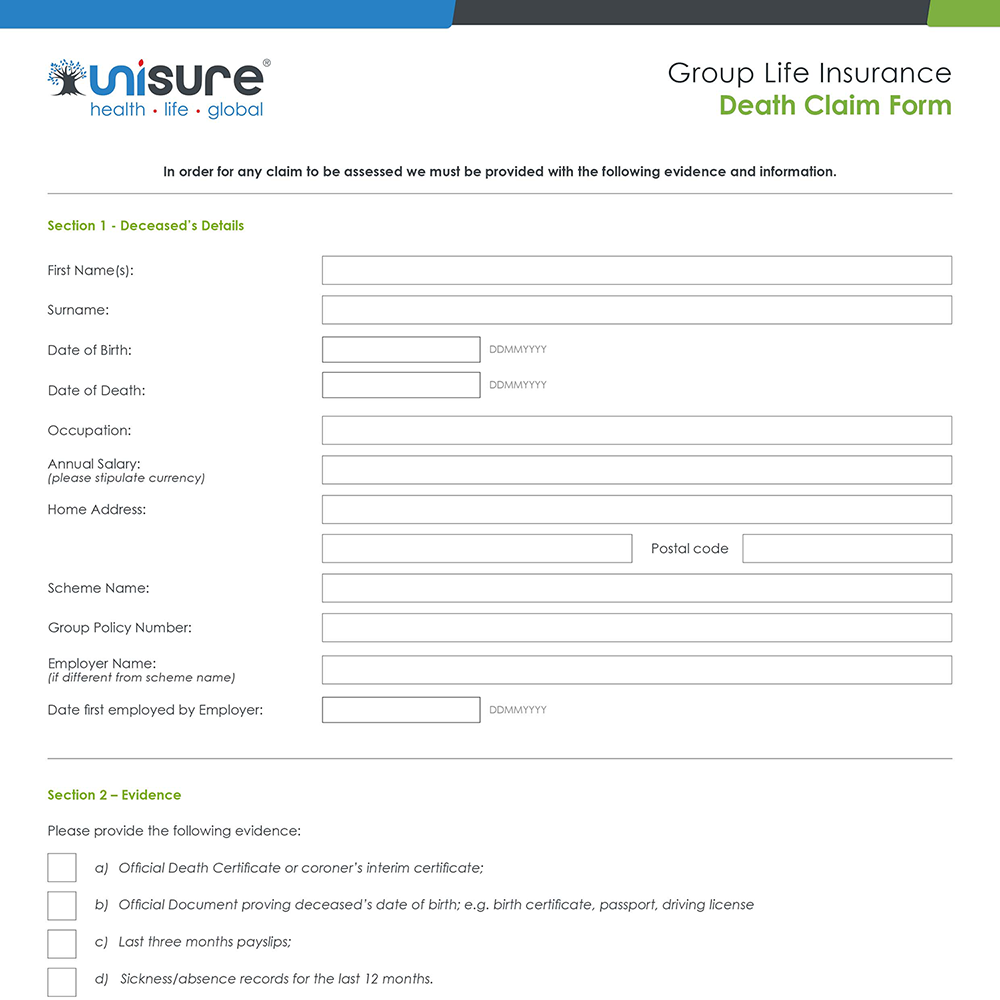

Death Claim Form

Unisure - Health Steps Flyer

Business Protection Flyer

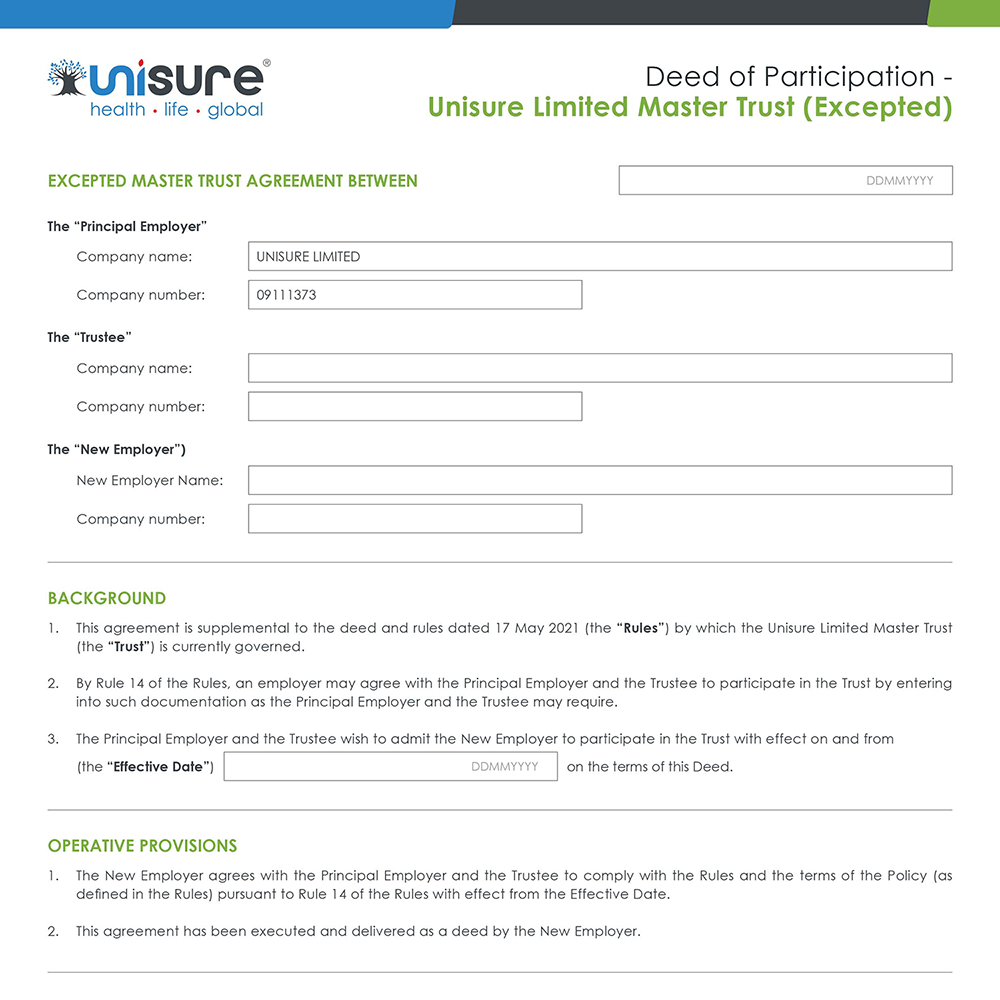

Deed of participation – Registered and Excepted

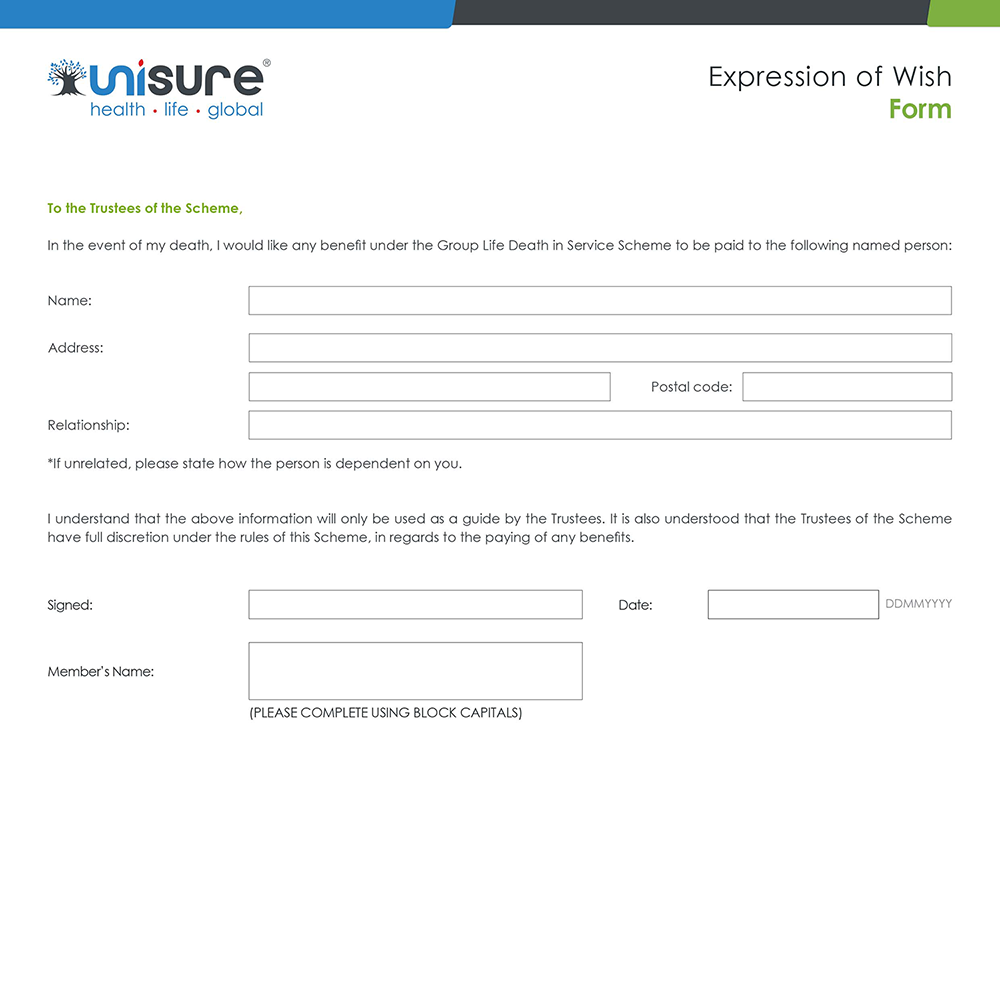

Expression of Wish Form

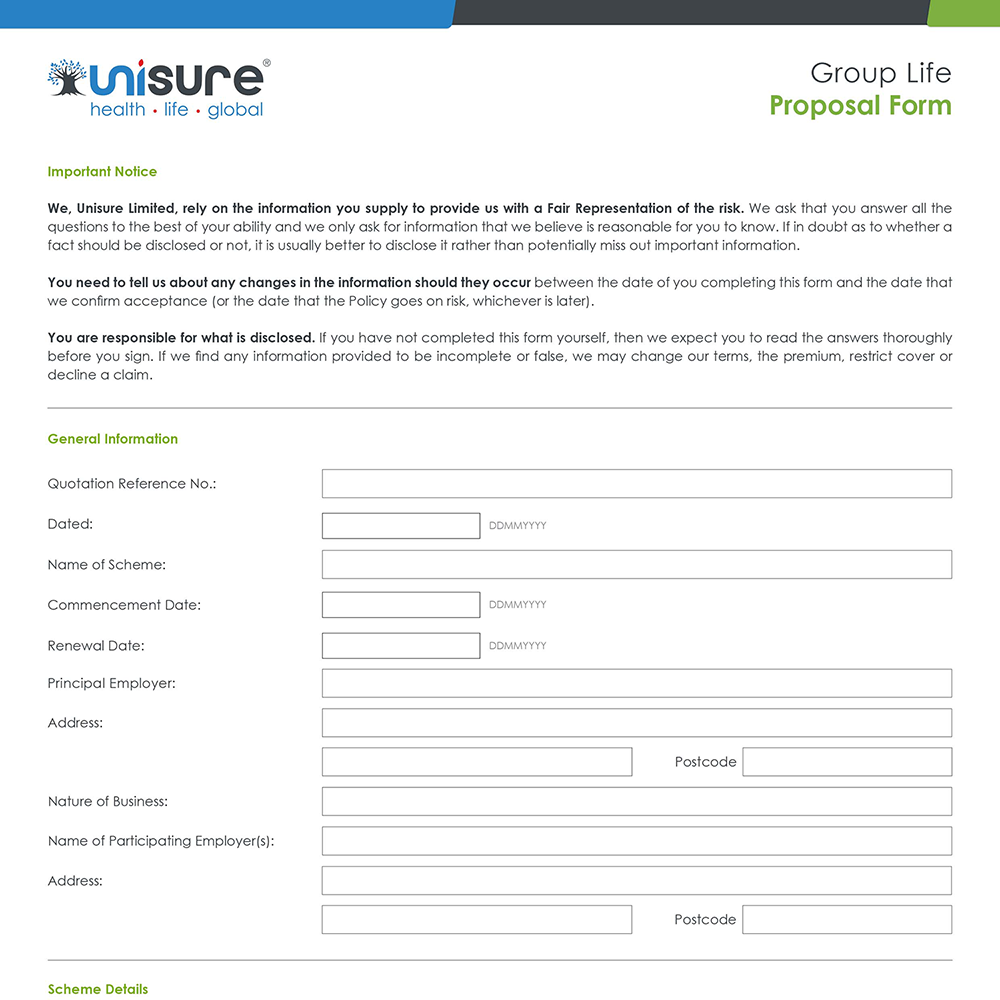

Group Proposal Form