The purpose of life insurance is to pay out a lump sum benefit after you pass away, providing your loved ones with financial security should the unthinkable happen.

Dependable cover that is portable

Guaranteed level

premiums

Approved claims

paid within 48 hours

Individual, Key Person, Shareholder and/or Mortgage protection

Emergency Evacuation, Critical Illness and Disability

As you progress through life, you may need life insurance to address the changing risks your dependants face.

Here are some examples of when life insurance may be important or necessary:

Most single people don’t have any financial dependants, but there are exceptions.

If you are supporting parents or sibling; or carrying significant debt you wouldn’t want passed on to family members, consider life insurance.

Many families depend on two incomes to make ends meet.

If your partner passed away, would you have enough money to cover their funeral costs, credit card balances, outstanding loans and daily living expenses?

If you passed away tomorrow, would your spouse or partner be able to financially provide your children with the opportunities you had planned for them?

Would there be enough income to pay for school, college or university as well as all the living expenses along the way?

For most people, the family home is their most significant financial asset and their mortgage is their most significant liability.

If you have a mortgage, consider taking out life insurance for the value of the mortgage to provide your family with the security of a fully paid home if the worst should happen.

If you passed away today, your partner could potentially outlive you by many years. Consider whether your partner would have to make drastic lifestyle adjustments to make ends meet and whether you have adequate life insurance cover in place to ensure you avoid financial struggles in retirement.

Certain governments levy some form of death duty, estate duty or inheritance tax on the estate of a deceased citizen or tax-resident, which must be settled by that person’s beneficiaries. Consider whether your family is exposed to this potential liability. If they are, life insurance is often the most cost-effective solution to help a family pay these taxes.

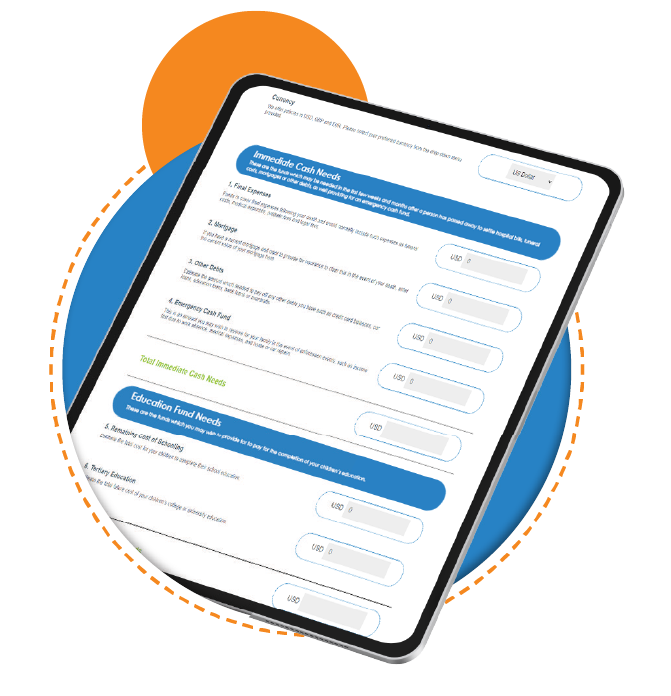

For your convenience, we’ve compiled a calculator to take you through this process.

For a quote on one of our International Health or Life Insurance solutions, or to meet with a Unisure expert, please fill in your details:

Unisure Limited is a Unisure Group company. Unisure Limited is registered in England and Wales with company registration number 9111373, and is authorised and regulated by the United Kingdom Financial Conduct Authority, with FRN 719400.

2024 © The Unisure Group. All rights reserved. E&OE.